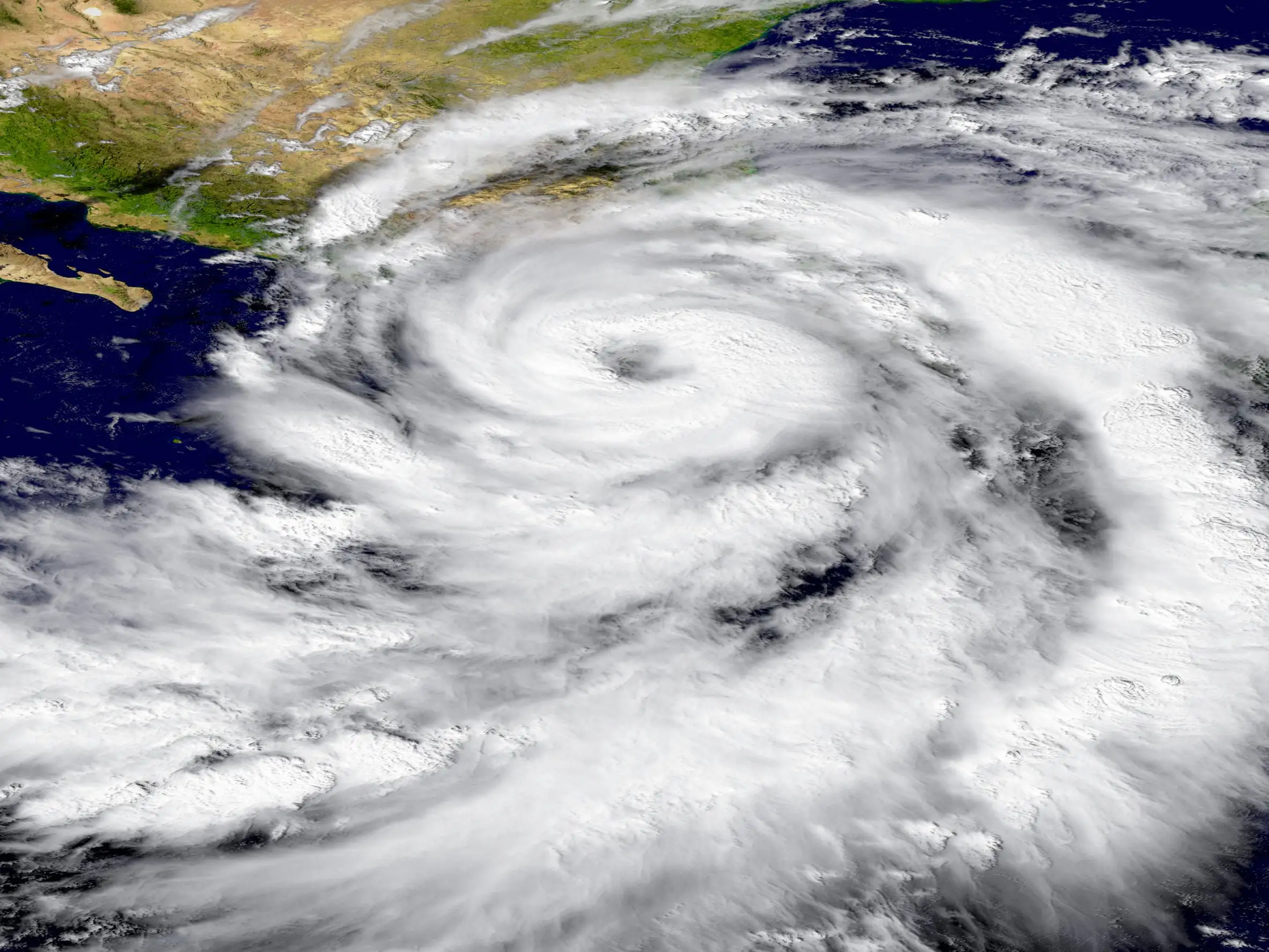

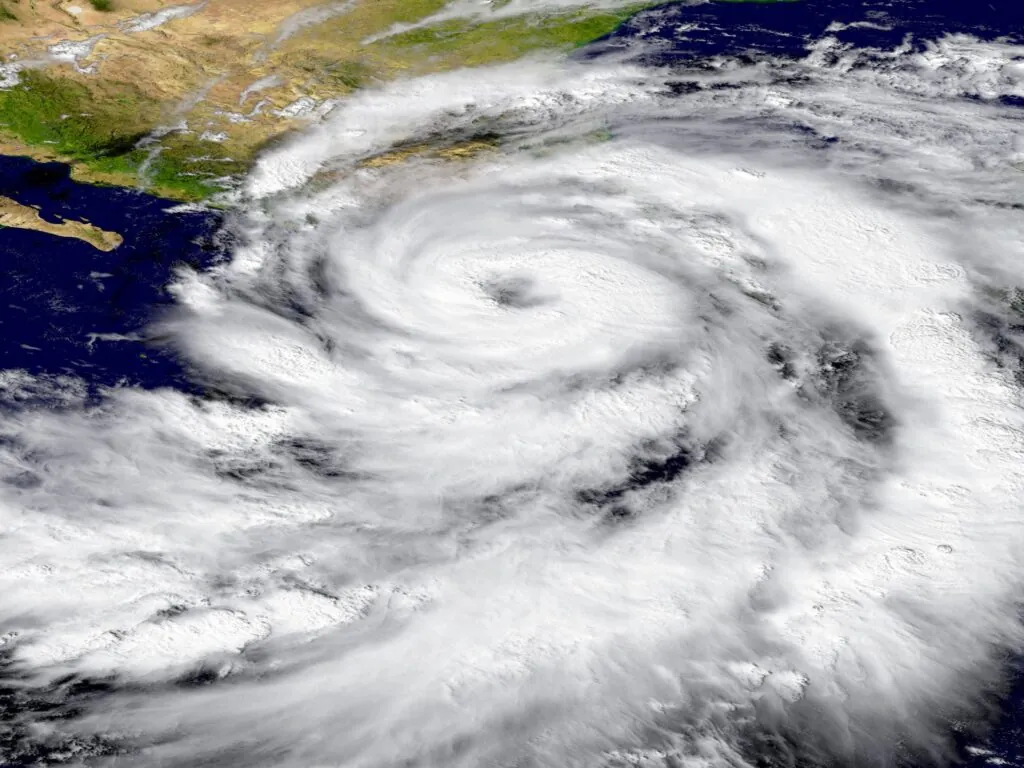

If You Suffered Damage from Irma, You Can Still Apply to FEMA

If you are a survivor of Hurricane Irma in Florida, the Federal Emergency Management Agency (FEMA) is still offering assistance – but not for much longer. You must act quickly if you need federal help.

The date has been extended so you can file for FEMA individual disaster assistance through Nov. 24. FEMA extended the deadline for anyone who needs coverage for personal property loss, home repairs, or rental assistance which has not been covered by insurance.

How to get help from FEMA

Contact FEMA online at disasterassistance.gov or call the FEMA Helpline at 800-621-3362, 7:00 a.m. to 11:00 p.m. every day of the week.

You can also access other recovery resources, including unemployment help, family services, and mental health services.

How to file a flood claim

There are several steps in filing a flood claim related to Hurricane Irma, and if you understand them upfront, your process will proceed more smoothly.

Before you have an appointment, you can take several steps on your own.

- Clean up as much mold as you can. Insurance policies don’t always provide coverage unless you have tried to prevent the mold spread. If it’s not possible due to blocked roadways or floodwaters, take photos to document.

- Take photos of all damage before you throw away any items. Keep samples of items like carpeting, window treatments, and upholstery. Document the make, model, and serial numbers of appliances with photographs. The more photos you take, the better chance that you will receive full replacement value.

- Throw out any items that may pose a risk to your health. Such as spoiled food or cushions. Make sure you take a photo first, though.

- Ask about an advance payment. Some funds may be available to you before the adjuster files the claim.

When you’re ready to file a claim, contact FEMA at the links listed above. Then have these items ready for your application process:

- Your Social Security number

- Your address (or address of the damaged site)

- Damage description

- Insurance policy information

- Phone number

- Mailing address

- Bank account information for direct deposit purposes

FEMA will send an adjuster to visit your property. A legitimate adjuster will provide official identification and contact information. The adjuster will perform a property inspection using photos and measurements. They will explain your eligibility for an advance payment. They will also explain how the insurance company will process your claim.

For Hurricane Irma survivors, the Proof of Loss initial filing requirement has been waived. However, if you find additional damage, you have one year from the finding to file Proof of Loss. You will also need Proof of Loss if you have a dispute about insurance payout amounts or a dispute with your contractor’s estimate as compared to the initial report.

Getting the Hurricane Irma Recovery Money You Need

Bad faith insurance and be able to help you. Unfortunately, many Hurricane Irma victims will fall prey to fraud or price gouging while rebuilding. Don’t be one of them. We can help you recover your losses. Contact us today for a free consultation.

About the Author:

A partner at Ben Murphey tries complex disputes that include civil appeals, maritime and admiralty claims, wrongful death, and labor disputes. Mr. Murphey has been recognized for his excellence in the area of personal injury litigation by being rewarded with a 10/10 Avvo Rating and named a Super Lawyers “Rising Star” for the last four consecutive years (2011-2014). Mr. Murphey regularly tries cases in state and federal courts around the country, being admitted to practice before all Florida courts and the United States Court of Appeals for the 11th Circuit.